The Evolution of Algorithmic Trading in the Cryptocurrency Space

The world of cryptocurrency trading has undergone a significant transformation in recent years, driven by technological advancements and the growing demand for automated investment strategies. One key aspect of this evolution is algorithmic trading, which has revolutionized the way cryptocurrency markets operate. In this article, we delve into the history, current state, and future of algorithmic trading.

The Early Days of Algorithmic Trading

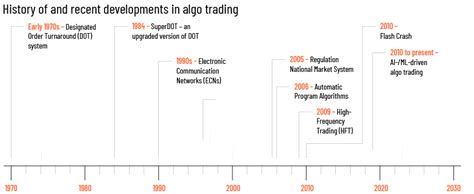

The concept of algorithmic trading dates back to the 1960s, when computers first became capable of performing complex calculations in real time. However, algorithmic trading only began to gain traction with the rise of high-performance computing in the 1990s. The first algorithmic trading platform was launched in 1995 by Andrew Clay Shafer and Richard Suter, who developed a strategy based on stock market patterns.

The early days of algorithmic trading were marked by skepticism from regulators and investors, who questioned the reliability and fairness of automated investment decisions. However, as the field grew, so did its appeal. In 2004, the first cryptocurrency, Bitcoin, was launched, and algorithmic trading platforms began to emerge to capitalize on this new opportunity.

The Rise of Cryptocurrency Algorithmic Trading

The mid-2000s saw the introduction of blockchain technology, which enabled decentralized data storage and processing. This marked a significant turning point in the evolution of algorithmic trading in the cryptocurrency space. The first cryptocurrency exchange, Coinbase, launched in 2012, allowing users to buy and sell cryptocurrencies like Bitcoin.

The rise of cryptocurrency exchanges has led to an explosion of new platforms designed to support algorithmic trading strategies. These platforms use machine learning algorithms to analyze market data, predict trends, and place trades on behalf of users. The use of these algorithms has helped create a more efficient and automated cryptocurrency market.

The Current State of Algorithmic Trading

Today, algorithmic trading is an integral part of the cryptocurrency ecosystem. Many exchanges offer built-in trading platforms that incorporate algorithmic strategies, allowing users to trade cryptocurrencies with relative ease. The rise of decentralized finance (DeFi) has also led to the development of new algorithmic trading platforms that focus on lending and borrowing cryptocurrencies.

The use of machine learning algorithms in algorithmic trading has become increasingly sophisticated, allowing platforms to analyze vast amounts of market data and make predictions based on complex mathematical models. This has resulted in improved performance and greater efficiency in the cryptocurrency markets.

Types of Algorithmic Trading Strategies

There are several types of algorithmic trading strategies in the cryptocurrency space, including:

- Market Making: This strategy involves using the liquidity pool of an exchange to buy or sell cryptocurrencies at prevailing market prices.

- Arbitrage: This strategy involves taking advantage of price differences between two markets by buying one currency and selling the other.

- Scoring: This strategy involves assigning a score to each trade based on its performance, with the aim of maximizing returns.

Challenges and Limitations

While algorithmic trading has revolutionized the cryptocurrency market, it also comes with a number of challenges and limitations. These include:

- Regulatory Uncertainty

: Regulators continue to grapple with the impact of algorithmic trading on their regulatory frameworks.

- Cybersecurity Risks

: The use of complex algorithms can make data exchanges vulnerable to cyber threats, which could have devastating consequences for users and market participants.

VN

VN