Understanding the effects of Tether on the market trends for cryptocurrency: a guide to the crypto hand

The world of cryptocurrencies has recorded rapid growth and volatility in recent years. As a result, retailers and investors are constantly looking for ways to manage risks, maximize profits and be ahead of the market trends. A critical factor that affects cryptocurrency trade is the value of Tether (USDT), a asset that sticks to the US dollar.

In this article we will deal with the world of Tether and their influence on the market trends for cryptocurrency. We will investigate how Tether’s stability affects trade strategies and provide instructions for the navigation of these fluctuations.

What is binding?

Tether (USDT) is a decentralized stable coin created by the London School of Economics (LSE). Its main function is to maintain the determined value between 1 USD and 1 Bitcoin (BTC). This ensures that the value of each unit remains relatively stable and is not influenced by market fluctuations.

The effects of Tether on the cryptocurrency market trends **

The stability of Tether has a significant impact on the market trends for cryptocurrency. If investors buy or sell assets that Tether use as collateral, they effectively reduce their exposure to price volatility. This facilitates the dealers to navigate volatile markets and manage the risk.

Here are some options for how the Tether affects market trends:

- Reduced volatility : With the stability of Tether, investors can block profits from long positions without making massive losses due to short -term fluctuations.

- Increased liquidity : Ther’s Pegled Value ensures that liquidity flows into markets when prices are volatile, which makes it easier for dealers to enter or leave positions.

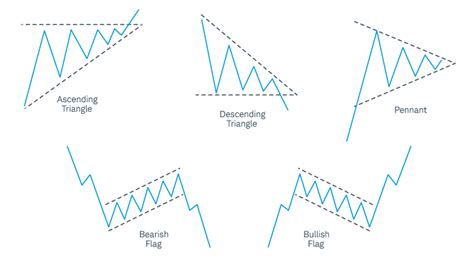

- Stability of asset prices : The StableCoin effect helps to maintain the relative stability of the asset prices and enables dealers to focus on other market factors such as technical analyzes and basic research.

How the Tether affects trade strategies

Therms effects on trade strategies are diverse:

- Asset Allocation : Dealers often indicate their portfolios between cryptocurrencies and other assets that Tether use as collateral. By compliance with part of your portfolio, retailers can maintain liquidity and reduce the volatility of the market.

- STOP-LOSS orders : The stable coin effect helps dealers to set stop-loss orders more effectively and reduce the risk of significant losses due to short-term price fluctuations.

- Risk management

: dealers who use Tether as security can implement stricter stop-loss boundaries to ensure that they only risk a small amount compared to their entire portfolio.

Tips for trading with Tether

To navigate the market trends influenced by Tether, follow the following tips:

- Display your portfolio : Approach part of your portfolio of binding base such as USDT, DAI or USDCEP.

- Use Stopless orders : Set Stopless orders to limit potential losses due to short-term price fluctuations.

- Concentrate on basic analyzes : Prioritize basic research and technical analysis before the market mood, which can be influenced by the stable coin effect.

- Consider the feelings of the market : Take an eye on the market mood, but avoid making impulsive decisions exclusively in the mood.

Diploma

The effects of Tether on the market trends for cryptocurrencies are significant and offer dealers a stable basis for navigation over volatile markets. If you understand how the Tether affects trade strategies and uses the right tools and techniques, you can remain the market fluctuations and maximize your profits in the world of cryptocurrencies.

Remember that no investment strategy can completely eliminate the risk. By combining basic analyzes with technical research and risk management techniques, you can reduce the commitment of market volatility and make more well-founded decisions about your business.

VN

VN