How to use trading psychology to avoid losses: Guide to mastering the art of cryptocurrencies

As the prices of the cryptocurrency fluctuate wildly, many merchants arrest themselves due to unexpected losses. However, with a firm understanding of trading psychology and well -executed strategy, it can minimize your risk and maximize the potential yields of the world of digital devices.

Understanding Trading Psychology

Trading psychology refers to the mental and emotional factors that affect the decision -making process during trade. It is essential to recognize these psychological bias as they can help or hinder their success. Some general psychological distortions are as follows:

- Fear : Fear of loss can lead to over -planning and make impulsive decisions that result in significant losses.

- Overexual : Overestimation of your abilities and underestimating risks can lead to negligent trading decisions.

- Anchor Distortion

: Relying too much on past performance or single event can prevent you from adapting to changing market conditions.

Use of commercial psychology to avoid losses

In order to avoid losses, a deep understanding of the factors influencing the factors of their own trading psychology and the decision -making process is essential. Here are some strategies to help you use trading psychology to minimize risk:

- Set the clear goals : Determine your trading goals and set realistic expectations. This helps to remain concentrated and avoid emotional decisions.

- Use Stop-Loss Orders : Set a Stop-Loss order to a fixed price level to limit possible losses if you are a significant price start against you.

- Diversify your portfolio : Distribute your investments to various asset classes, currencies or markets to reduce the exposure of a given market or event.

- Use Risk Management Techniques : Do strategies such as position size, profit goals, and stop-loss levels to treat risk effectively.

- Stay under calm pressure : Practice relaxation techniques such as deep breathing or meditation to maintain a clean mind in high pressure trading situations.

- Review and set up your strategy : Review your trading plan regularly and change it as needed to ensure that you are effective.

Use of behavioral trading psychology

In addition to understanding your own psychology, you can also prefer behavioral trading psychological strategies that help adapt to changing market conditions. They belong to:

- The PND Method : This method includes the time representation of the prices of a particular device using two different formulas to identify samples and predict future price movements.

- Fibonacci Reversal Indicion : This indicator uses fibonacci levels to indicate a potential reversal of price, helps to predict market shifts and adjust the trading strategy.

- Market Emotional Analysis : It monitors market emotions with tools such as emotional analytical software or social media platforms to identify trends and predict future market movements.

With technical analysis

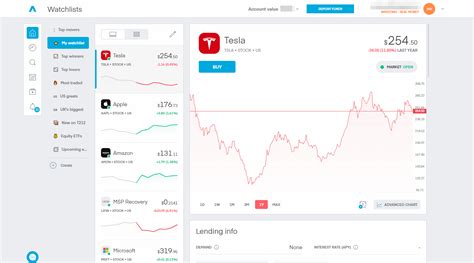

Technical analysis involves studying the samples and trends of a particular device over time using diagrams, diagrams and technical indicators. This approach can help:

- Determine the trend reversal : Use technical indicators such as RSI (relative strength index) or MACD (moving average convergence divergence) to identify potential trends.

- Forecast for price movements : Use chart patterns and trend lines to predict future price movements based on historical data.

- Avoid exaggeration : Avoid over -design by entering only commerce if you have sufficient market exposure and risk management strategies.

Conclusion

Trading psychology is a fundamental aspect of successful cryptocurrency trade.

VN

VN