Market signals and their impact on solana (Sol) investors

The cryptocurrency world has become increasingly volatile in recent years and prices are rapidly fluctuating due to various market signals. Investors interested in Solana Blockchain’s network, understanding these signals is essential for making conscious decisions about buying or selling solo Sol. In this article, we will go into different types of market signals and are influenced by Solana (Sol) investors.

What are market signals?

Market signals refer to price movements indicating a certain direction in the cryptocurrency market. These signals can be influenced by a variety of factors including supply and demand, adoption level, development of regulatory enactments and technological advances. Different market signals may have different effects on Sol investors, but most often they cause more uncertainty and possible losses.

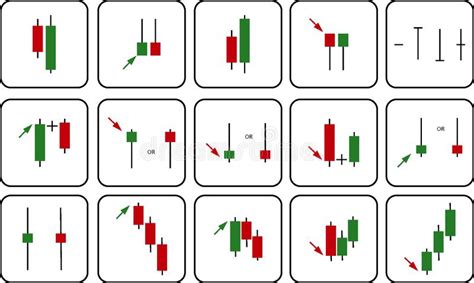

Market Signal Types

There are several types of market signals that can affect Solana (Sol) investors:

- Buy or hold : When prices rise due to demand, this is a sign that investors buy currency at lower prices. Investors should sell their bench if they expect a significant increase in prices in the future.

- For sale or hold : On the contrary, if prices are reduced due to demand reduction, it can be a signal for investors to sell their Sol before prices fall.

3

Buy fall : This happens when prices are extremely low and investors want to buy back at lower prices. It is important to take caution here, as buying low prices does not guarantee future benefits.

- Sell for rejection : When sellers are aggressively rejecting new prices, this may indicate that buyers are hesitant to enter the market, causing potential losses to investors.

- Fear and greed

: This is an emotional state in which investors are likely to buy or sell based on fear of disappearing (FOMO) rather than rational decision making.

Market Signals Effect on Solana (Sol) Investors

Market signals can have a significant impact on Sol investors, affecting their return and overall investment strategy. Here are some main consequences:

- Risk tolerance

: When prices increase or fall significantly, it may indicate that the market is more volatile than investors expected. This could lead to an increased risk of tolerance for investors who want to take more risks to gain greater potential benefits.

- Investment Strategy : Market signals can affect the investor’s strategy. For example, if prices rise and then fall quickly, investors may need to adjust their investment portfolio to avoid significant losses.

3

Penny Stocks : Solana (Sol) is often classified as a penny stock, which means that its price can fluctuate rapidly due to market signals. Investors need to be aware of the risks related to this classification and carefully conducted pre -investment Sol.

Why are market signals important for Solana (Sol) investors?

Understanding market signals is essential for Sol investors as they provide a valuable insight into the cryptocurrency market dynamics:

1

Risk Management : By recognizing possible market signal changes, investors can adjust their investment strategy to reduce losses and increase benefits.

- Diversification : Market signals can help investors diversify their portfolios by identifying opportunities in different asset classes or markets.

3

Informed decision -making : Recognition of market signals allows investors to make more informed decisions on buying or selling Sol, reducing the possibility of emotional decision -making.

Conclusion

Market signals are an essential aspect of cryptocurrency investment, especially for Solana (Sol) investors.

VN

VN