The Allure of Cryptocurrency Trading: Exploring the Crypto, Coin, and Futures Markets

Cryptocurrencies have gained a lot of attention in the financial world in recent years. From their initial price fluctuations to their growing acceptance by the general public, cryptocurrency trading has evolved into a complex ecosystem that includes various instruments such as coins (cryptocurrencies), futures contracts, and arbitrage opportunities.

Cryptocurrency: The Revolutionary Currency

The concept of cryptocurrency dates back to 2009, when Satoshi Nakamoto published the Bitcoin white paper. The goal of this open-source project was to create an alternative, decentralized currency that would eliminate the need for central banks and governments to issue fiat currencies. The first block on the blockchain was mined in 2009, and thousands of digital coins have been created since then.

Coins: digital currency category

Coins are a type of cryptocurrency designed to be easy to use, versatile, and secure. They are typically used for transactions and can be stored or traded digitally like fiat currencies. Each coin has its own unique characteristics, such as block time, transaction fees, and mining fees.

Futures: A Contractual Instrument

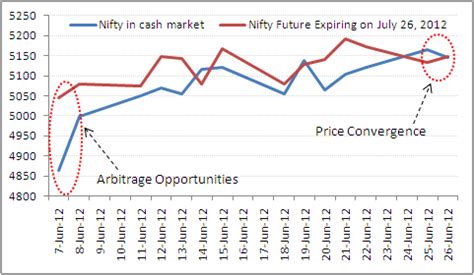

Futures contracts allow users to speculate on the price of an asset at a later date without physically owning the asset itself. This instrument is often used in financial markets to hedge against risk or to profit from price fluctuations.

Arbitrage Opportunities

Arbitrage is the process of taking advantage of the difference in buying and selling prices in two or more markets. Arbitrage opportunities can arise in cryptocurrency trading when there are significant price differences between different exchanges or platforms. By buying low on one exchange and selling high on another, traders can profit from these price differences.

Cryptocurrency Futures Arbitrage Market

In recent years, the cryptocurrency futures arbitrage market has gained enormous attention due to its profit potential. In this market, cryptocurrencies are traded against their futures contracts, taking advantage of the price differences between the two instruments.

There are several factors that contribute to the attractiveness of this market:

- Market Volatility: Cryptocurrency prices can fluctuate rapidly, which offers traders the opportunity to profit from price differences.

- Futures Market Liquidity: The crypto futures market has grown significantly in recent years, with an increasing number of exchanges and platforms offering futures contracts for various cryptocurrencies.

- Arbitrage Potential: The use of complex algorithms allows traders to take advantage of price differences between different markets, which makes this market particularly attractive.

Advantages and Disadvantages

Arbitrage in the cryptocurrency futures market offers several advantages, including:

- Decentralization: By trading cryptocurrencies against futures contracts, traders can diversify their portfolios, reducing their reliance on a single asset.

- Liquidity: The crypto futures market has grown significantly in recent years, making it easier for traders to access liquidity.

However, this market also has its drawbacks:

- Risk: Cryptocurrency prices can fluctuate rapidly, posing risks for traders who may not be able to handle these price fluctuations.

- Regulatory Uncertainty: The cryptocurrency futures arbitrage market is subject to regulatory uncertainty, which may impact trading and profits.

Conclusion

The cryptocurrency futures arbitrage market has received a huge amount of attention in recent years due to its potential for profit. By understanding the mechanics of these markets, traders can better manage their complexity and exploit arbitrage opportunities to profit from price differences between different assets.

VN

VN