Unlocking mystery to predictive trafficking with candle patterns

The world of crypto -trading is known for its high -risk, high reward. Thanks to the available quantity of cryptocurrencies, informed investment decisions can be difficult. One powerful tool, however, lies hidden in the eyes – patterns of candles.

Candle charts have been the basis of technical analysis for centuries and remain an essential part of the crypto -trading. In this article, we immerse ourselves into the world of candle patterns and explore how to use them to predict the price movements in cryptomains.

What are candle patterns?

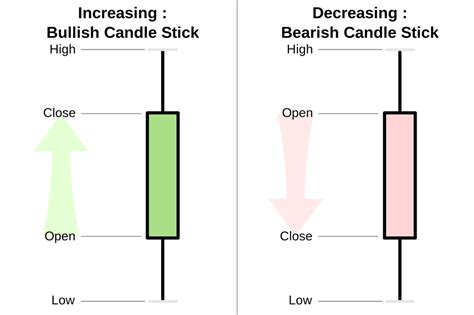

Candle patterns are a graphical representation of prices that show opening, high, low and near price assets for a given period. These formulas can be used to identify trends, identify twists and predict future prices movements. The most common type of candlestick pattern is

Hawk-Sky (also known as

bullish engulfing ).

How the candle patterns work

Candle patterns work with a series of prices series over time. This is how it works:

1.

- Movement of prices : Cryptomena price moves up or down from the starting price for the final price.

- Opening of candles : The investor observes the candle that has closed, with a high price higher than the low price.

4

- HAWK-SKY turnover: Hawk-Sky turn is identified as a potential sign of the upcoming price movement.

Types of candle patterns to be used for trading with cryptocurrencies

In the predictions, it is necessary to identify and analyze the correct types of candles patterns in cryptom trading. Here are some popular:

* Bullish Sunulfing : Bullish pattern that is formed when the lower closer closes above the top maxia.

* Bearish engulfing : Bearish pattern that is formed when higher high closer below the lower low level.

* Shooting Star : Bear pattern of twists, where the price drops to the lowest point before jumping.

* Hammer

: Bullish foreign formula where the price drops, then rises without much resistance.

Tips to identify candle patterns

Precise predictions of pricing movements using candles patterns:

1.

- Identify key levels : Use key levels, such as support and resistance level to guide business decisions.

3

Use more time frames : Analyze different time frames to get a better view of market activity.

- Practice, Practice, Practice : Develop your skills by practicing fake money or demo account.

Conclusion

Candle patterns are an invaluable tool in crypto -trading that offers information on prices and potential reversal movements. By managing the use of candle formulas, investors can increase their chances of profitable stores. Be sure to train with fake money or demonstration account before risking real capital.

Reneeing

: This article is intended only for information purposes and should not be considered investment advice. Crypto -trading poses significant risks and it is necessary to carry out thorough research and consult with experts before taking any decisions.

VN

VN