Technical Analysis Power in the Cryptumeluta TRADE

The cryptocurrency trading is becoming increasingly popular in the last few years, and many investors have been using different methods to try and make profits. One of the most effective ways of approaching the trading CRIPTO currency is through technical analysis (TA). In this article, we will explore how to use a technical analysis for better trading on the cryptocurrency market.

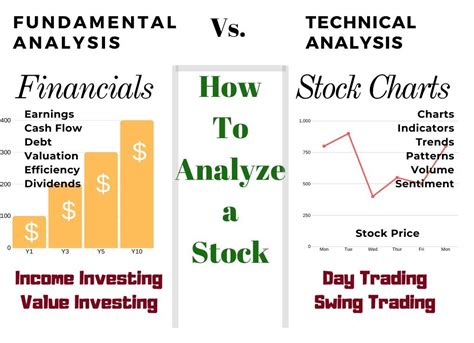

What is a technical analysis?

Technical analysis is an approach to assessing securities or markets based on forms and trends of pricing data. These include analysis of different samples of charts, indicators and other technical tools for making informed investment decisions. In the context of cryptocurrencies trading, technical analysis helps traders identify potential options for buying and selling a chart analysis.

Why use a technical analysis for cryptocurrency trading?

Crypto currencies are known for high volatility and fast prices fluctuations, making them an attractive market for technical analysts. Using a technical analysis for charts and patterns analysis, traders can better understand the dynamics of the market and make informed decisions to buy and sell.

Type of Tools for Technical Analysis

There are several types of technical analysis tools used by traders in the cryptocurrency store, including:

- Graph samples : These are graphic price movements over time, such as triangle formations, wedges and shoulders.

- Indicators : These are mathematical calculations based on the chart data, such as moving average, RSI (relative strength index) and bollinger scope.

- Trend line

: These are straight lines that connect key prices levels to identify the market trends.

- Support and resistance level : These are areas where prices have historically bounced or encountered resistance.

How to use a technical analysis for better trading

To effectively use technical analysis in the cryptocurrency store, follow these steps:

- Select Graph : Select a chart showing enough details to analyze the price movement over time.

- Identify patterns and trends : Seek samples such as triangle formations, wedges and wounds of head and shoulder, such as trends like swing up or down.

3

- Set Alert Systems : Set Warning Systems to inform you of potential purchases and sales options based on your analysis.

- Determine trading rules : Based on your analysis, determine which trading rules you want to follow, such as shopping when the price is below a particular level and sale when it is up.

Best Practice for the use of technical analysis in the cryptocurrency store

To maximize the effectiveness of technical analysis in the cryptocurrency trade:

- Being ongoing with market news : Stay informed about market news and events that may affect your stores.

- Use multiple charts : Use more charts for analyzing different market aspects and identifying potential patterns and trends.

- Avoid emotional decisions : Avoid making emotional decisions based on fear, greed or panic.

- Diversify your portfolio : Diversify your portfolio by investing in various crypto currencies and markets.

Conclusion

Technical analysis is a powerful tool for merchants who want to make informed investment decisions in the cryptocurrency market. Using graph forms, indicators, trends lines and support levels and resistance, traders can recognize potential to buy and sell and make more effective trading decisions. Remember to stay in progress with market news and use more charts to maximize your effectiveness.

VN

VN