The Dark Side of Crypto Trading: Understanding the Risks and Dealing with Fear-Mongering (FUD)

As the world of cryptocurrency trading continues to grow in popularity, a new set of risks has emerged that can be detrimental to even the most experienced traders. One of the most prominent concerns is the phenomenon of FUD – Fear-Mongering, which can lead to reckless and impulsive decision-making.

In this article, we will delve into the world of crypto trading, explore the concept of limit orders, and examine how fear-mongering can affect the market.

What are limit orders?

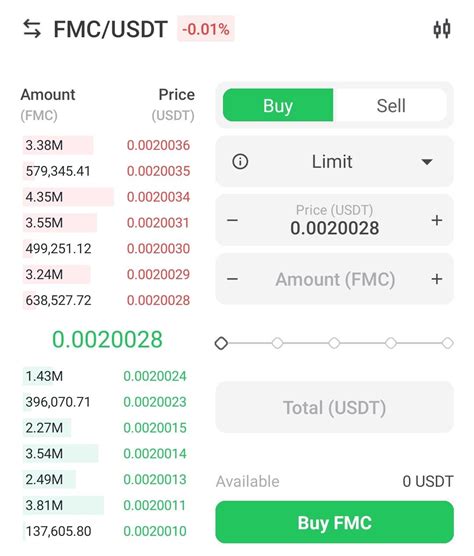

A limit order is a type of buy or sell order that specifies a specific price at which the trade should be executed. It is essentially an agreement with a broker to buy or sell a certain amount of cryptocurrency at a predetermined price, as long as it reaches that price without going beyond it.

Limit orders can take many forms, including a market order (buy or sell at the current market price), a limit stop-loss order (set a price at which to automatically sell if the trade falls below that value), and a limit up-stop order (set a price at which to automatically buy if the trade rises above it).

The Power of Limit Orders

Limit orders can be incredibly powerful in the world of crypto trading, allowing traders to:

- Set your own entry and exit prices

- Avoid market volatility by buying or selling at specific prices

- Use stop-loss orders to limit potential losses

However, with great power comes great responsibility. If a trader uses a limit order without proper risk management, they can easily trigger a stop-loss order, resulting in significant losses.

The Dark Side of FUD

Fear-mongering, or FUD (Foolish Unreliable Dealers), is the practice of spreading false and misleading information about a particular cryptocurrency in order to drive down its price. Traders who engage in FUD often use social media, online forums, and other channels to spread rumors and misinformation.

The effects of FUD on the market can be devastating:

- Market Volatility: FUD can lead to a spike in panic buying or selling, causing prices to drop rapidly.

- Liquidity Loss: When many traders are forced out of the market due to fear, liquidity can become scarce, making it difficult for others to buy or sell their cryptocurrencies.

- Trader Wallets

: FUD can cause investors to abandon their positions, resulting in significant losses for those who remain in them.

Dealing with FUD: Strategies for Success

While FUD is an inherent risk in the world of cryptocurrency trading, there are strategies that can help traders manage it and minimize its impact:

- Stay informed, but don’t act impulsively: Stay on top of market news and trends, but avoid making emotional decisions based on speculation.

- Diversify your portfolio: Spread your investments across different cryptocurrencies to minimize the risk that any single trade or position will go bad.

- Set stop-loss orders: Use limit orders with stop-losses to automatically sell if prices fall below a certain level.

- Use reputable sources: Verify information through trusted sources before sharing it online.

Conclusion

While FUD can be a significant threat in the world of crypto trading, understanding its risks and strategies can help traders navigate these challenges. By staying informed, managing risk, and using effective emotion management tools, traders can minimize the impact of fear mongering and make more informed decisions about their investments.

Remember, in the fast-paced world of cryptocurrency trading, it is essential to be aware of the potential for FUD and take steps to protect yourself and your investments.

VN

VN