Market psychology and its impact on Litecoin prices (LTC)

The cryptocurrency world has been a home for speculation, excitement and volatility in recent years. Among the many cryptocurrencies available, Litecoin (LTC) is distinguished by its unique mixture of speed, decentralization and conviviality. As with any market, understanding the underlying psychology that makes it crucial to make informed investment decisions. In this article, we will immerse ourselves in the concept of market psychology and explore how it affects Litecoin prices.

What is market psychology?

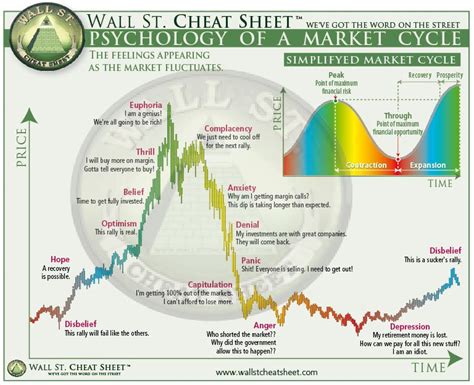

Market psychology refers to the study of how human behavior influences market movements and price trends. It includes various psychological factors that affect investor attitudes, risk tolerance and decision -making processes. Understanding these psychological engines helps traders, investors and market analysts to navigate in the complexities of the cryptocurrency markets.

Keys to the price of liters: fear and greed

Litecoin prices are influenced by a combination of fear and greed. Fear occurs when investors become concerned about market volatility, uncertainty or potential risks. In this context, the LTC is often considered as an asset “with coverage”, offering a safe refuge for those looking for stability in a rapidly evolving world.

On the other hand, greed plays an important role in Litecoin prices movements. When prices increase, this may be due to speculation, media and excitement among market players. Conversely, when the SLD falls, this could indicate that investors have become too optimistic or rush to buy at an inflated price.

Factors influencing the feeling of the market

Several factors contribute to the feeling surrounding Litecoin:

- feeling of feeling : The feeling of feeling measures the collective attitude of traders towards a particular cryptocurrency. A high feeling index may indicate an increase in optimism and increase.

- News and events

: Percées in technology, partnerships or regulatory changes can arouse excitement among investors, which increases LTC prices.

- The managers of the feeling of the market : investors often follow market leaders (for example, bitcoin) to assess the global mood of the cryptocurrency market. When these leaders experience a strong feeling, this can influence Litecoin prices.

- Social media and online communities : Social media platforms and online forums provide investors with a conduit to share their opinions and engage with each other. This can create a snowball effect, where increased discussion and speculation lead to higher LTC prices.

Case study: market psychology and Litecoin price

To illustrate the impact of market psychology on liters prices, let’s examine the price movements of cryptocurrency during specific events:

- May 2018: Litecoin experienced a significant increase in its price after a major upgrade of its scalability solution, Lightning Network. This event encountered an extremely positive feeling index (75%), which indicates that investors were optimistic about the future prospects of LTC.

- October 2020: After the Pandemic of COVID-19 and subsequent economic uncertainty, SLD prices have dropped sharply. The feeling index fell to a minimum of 20%, reflecting concerns about market volatility.

Conclusion

Market psychology plays a crucial role in the training of liters prices. Fear and greed are two main engines that influence investors’ attitudes towards SLD. By understanding these psychological factors, traders and investors can better navigate in the complexities of the cryptocurrency markets and make informed decisions.

Although past price movements can serve as a guide to predict future trends, it is essential to approach market analysis with a nuanced perspective, considering several sources and indicators.

VN

VN