The Future of Finance: How Crypto, Portfolio Diversification, Decentralized Exchanges, and Transaction Speed Are Revolutionizing the Market

The World of Finance is undergoing a significant transformation with the emergence of blockchain technology and cryptocurrencies. As the market continues to evolve, investors are seeking new ways to diverse their portfolios and capitalize on emerging trends. In this article, we will explore three areas that are driving innovation in the Crypto Space: Portfolio Diversification, Decentralized Exchanges (DEXS), and Transaction Speed.

Portfolio diversification

Investors are becoming increasingly aware of the importance of diversifying their portfolios to minimize risk and maximize returns. Traditional Investment strategies often rely on a small number of assets, which can be vulnerable to market fluctuations. However, Crypto Investors have discovered that by spreading their investments across multiple digital currencies, they can reduce their reliance on any one asset.

Portfolio diversification has led to the rise of cryptocurrency etfs (Exchange-traded funds) and mutual funds that track cryptocurrencies like Bitcoin, Ethereum, and Litecoin. These Assets Offer A Range of Benefits, Including:

* Reduced Risk : By Investing in Multiple Cryptocurrencies, Investors Can Spread Out Their Risk and Avoid Significant Losses If One Asset Experiences A Downturn.

* Increased Potential Returns : The Cryptocurrency Market is still relatively small compared to traditional assets, which means that the potential for higher returns on investment is higher when diversification is employed.

* Improved Liquidity : Many Crypto etfs and mutual funds are now listed on Major Exchanges, Making It Easier for Investors to Buy and Sell Their Investments.

Decentralized Exchanges (Dexs)

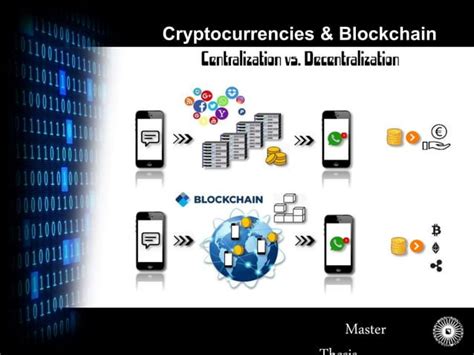

Decentralized exchanges have transformed the Way People Trade Cryptocurrencies. Unlike Traditional Exchanges, which are controlled by Central Authorities, Dexs Operate on Blockchain Networks, Allowing for Greater Transparency, Security, and Efficiency.

Dexs offer severe benefits, including:

* Lower fees : Transaction costs are typically lower on decentralized exchanges compared to centralized exchanges.

* Increased Liquidity : Dexs often have faster execution times and more reliable trading conditions than traditional exchanges.

* Improved Security : Since all transactions occur directly on the blockchain, there is less room for error and a lower risk of hacking.

Dexs Like Uniswap, Sushiswap, and Curve Offer a Range of Innovative Features, Including:

* Automated Market Makers : These platforms provide liquidity to users by offering competitive interest rates on their holdings.

* Staking Pools : Users can participate in the Governance of Decentralized Applications (DApps) and Earn Rewards in Return.

Transaction Speed

As cryptocurrencies continuing to rise in popularity, transaction speed has become a critical factor for investors. Traditional Payment Systems often days or weeks to process transactions, which can be costly for both buyers and sellers.

Blockchain Technology has addressed this issue by implementing faster and more Secure Transaction Processing Mechanisms, Such as:

* Fast Ledgers : These allow for faster validation of transactions, reducing the time it takes to confirm a transaction.

* Quantum-resistant Cryptography : This ensures that transactions are encrypted and protected from potential quantum attacks.

Dexs have also introduced new features that enhance transaction speed, including:

* Instant Payment Systems : Some Dexs Offer Instant Settlement Times, allowing for Faster Completion of Trades.

* Automated Order Book Management

: These platforms enable automated management of orders, reducing the time it takes to execute trades.

VN

VN