Orders for stopping: a key tool for minimizing risk in cryptocurrency trading

As the world of cryptocurrency trading increases, it is constantly growing, complexity and risk. Thanks to price variability and the potential of significant losses, traders are constantly looking for ways to minimize the exposure and maximize their profits. One of the effective strategies that turned out to be very effective is the use of losses for losses.

In this article, we will examine what are the orders for losses, how they work, and provide tips on how to effectively implement them in cryptocurrency trading.

What are orders for stopping?

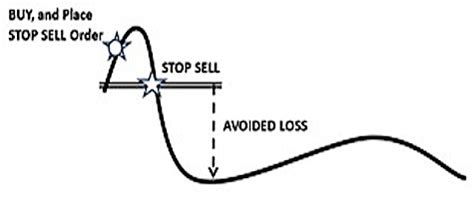

Ordering a loss of loss is a type of order placed with a broker or stock exchange that automatically sells (or closes) trade when it reaches a specific price level. The purpose of the detention order is to limit the potential losses related to the investment by limiting the amount of threatened capital in the event that the price moves against you.

How do the loss queues work?

This is step by step an explanation of how orders for losses work:

- Determining the loss price of the loss : traders have determined a specific price level that they want to protect their investment. This is usually the lowest point where they will sell or close their position.

2.

- Sales or closure : If the market price reaches the price of stopping before it reaches the price of the entry, ordering the loss of stopping will be launched and made automatically by a broker or exchange.

- Closing trade : After closing the trade, the trader is no longer involved in it and can close his position.

Benefits of ordering to stop

Orders to stop losses offer several benefits to traders, including:

- Risk management : By limiting potential losses, orders for loss losses help traders manage risk and avoid significant financial losses.

- Increased profitability

: When ordering to stop, traders are less likely to lose money on each trade, which can lead to an increase in profitability.

- Reduced emotional stress : Knowing that you have a plan to limit potential losses, it can help reduce emotional stress and trade anxiety.

Tips for the implementation of detention orders

To fully use orders for losses, traders should follow these guidelines:

- Set clear goals : traders should set specific price levels for ordering losses based on their risk tolerance and investment goals.

2.

- Monitor market conditions : traders should carefully monitor the market before entering new transactions to adjust the stop price if necessary.

4.

Popular types of loss orders

In cryptocurrency trading, cryptocurrency trading is commonly used, including:

- Automatic detention orders : These orders automatically sell (or close) trade when it reaches a specific price level.

- Orders of stopping stopping : These orders limit potential losses by selling or closing trade at a specific price level.

- Order on the stop market : This type of order sells or closes trade immediately after entering, without determining a specific price level.

Application

To sum up, orders for stopping losses are a powerful tool for minimizing risk in cryptocurrency trading and maximizing profits.

VN

VN