Development Aave (Aave): Unlocking the Force of Liquidation Pools

In The Cryptomen World, Liquuidity Funds Have Appeared as an Important Part of the Ecosystem. These platforms Allow Individuals to Combine Their Assets Together, Creating A Network Effect That Facilitates Smooth Trading and Reduces Transaction Costs. One of these projects that has gained considerable attention in recent years is aave (aave), a decentit credit protocol build on a blockchaine ethereum. In this article, we dive into the development of aave, its liquidity tasks and what makes it an attractive solution for traders and investors.

Letter History of Aave

Aave, founded in 2017, Yuga Koizumi, was initially a Credit Protocol Designed to Provide Decentralized Credit Solutions. The Aim of the Project was Originally Called “Licolism” to Create A Safer and Decentralized Alternative to Traditional Credit Platforms. In 2021, The Project Rebraled as aave and introduced its original cryptocurrency, aave.

Ecosystem or liquidity

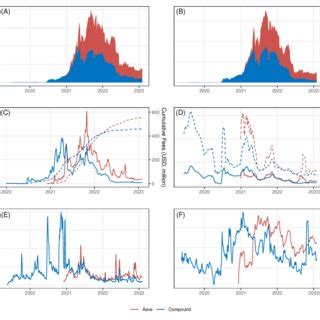

Liquuidity Fund is a decentralized Network of Merchants Who Associate Their Assets Together to Provide Liquuidity to a Specific Asset Or Market. Aave Has Been Helpful in Creating This Type of Liquuidity Fund, Allowing Users to Trade A Wide Range of Assets, Including A Cryptocurrency, Such as Ethereum (ETH), USD and More.

How works aave

Aave acts as a decentralized loan protocol, allowing users to borrow and borrow assets using a native aave cryptocurrency. Here is a high -level overview or how it works:

1.

- Loans : Users Can Insert Their Assets in Aave Protocol and Gain Interest in Aave as a Collateral. This process is Known as Loans.

- inserting : As users hold or borrow aave assets for a longer period of time, they are motivated to “put” their assets, which provides additional rewards in the form of aave tokens.

The role of liquidity funds in the cryptocurrency market

Fol’s Liquuidity Plays a Decisive Role in Facilitating Cryptom Trading and Market Activity. By providing a decentralized network of merchants who are able to combine their assets together, the liquidity funds allow:

1

- Decreased Cost of Transactions : Liquility Groups Reduce Transaction Costs by Eliminating the Need for Centralized Exchanges and Reducing the Risk of Slip and Other Technical Problems.

- Improved Market Efficiency : By providing a decentralized Network of Traders, The Liquidation Funds Improves The Market Efficiency by Facilitating Faster Implementation and Reduction of Overload.

Influence aave on cryptocurrency markets

Aave has a significant impact on cryptocurrency markets since its launch in 2017. Some remarkable aspects of aava influence include:

1.

- Increased Acceptance

: Aave Have Been Widely Accepted by Users Tryping to Gain Interest In Their Assets While Providing Liquuidity to Other Traders.

3.

Calls and Future Prospects

Althegh Aave Has Made Significant Advances in Its Development, Several Calls Need to Be Addressed:

1.

2.

VN

VN