Title: The Complexities of Crypto and the Impact on Price Volatility and TVL (Total Value Locked)

Introduction

The World of Cryptocurrency has Become Increasingly Popular in recent years, with many Investors Flocking to Explore its Potential for Growth. However, one aspect that is of overlooked is price volatility, which can significantly impact the value of cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Others. In this article, we will delve into the complexities of crypto, particularly focusing on TVL (Total Value Locked) and order book Dynamics to Understand How these Factors Influence Price Fluctuations.

What is Total Value Locked (TVL)?

Total Value Locked (TVL) refers to the Total Amount of Value that has bone locked up in a cryptocurrencies Decentralized finance (Defi) protocol, Such as a stablecoin or a defi lending platform. When users deposit funds into thesis protocols, They essentialy lock up their assets and cannot withdraw Them the Locking Period Expires. The TVL is an important Metric for Understanding the Liquuidity of a Market.

How Does Order Book Impact Price Volatility?

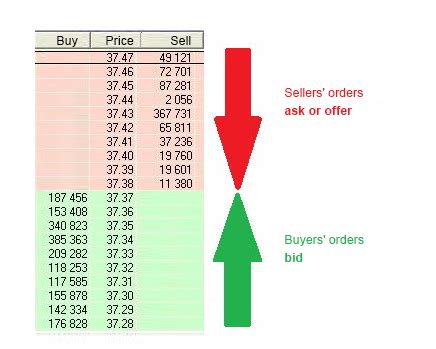

The Order Book Plays a Crucial Role in Shaping Price Dynamics in Cryptocurrency Markets. An order book is a data structure that representatives the bids and sacrifices from all parties willing to buy or sell a particular asset at a given price level. When there are multiple orders, it creates an imbalance in supply and demand, which can lead to significant price fluctuations.

In a market with a healthy order book, prices tend to be relatively stable as buyers and sellers negotiate trades. However, when the order book is imbalanced or participants Become extremely confident or bearish on a particular asset, prices may drop sharply or skyrocket. This is of referred to as a “book squeeze.”

Example: The recent market downturn in Bitcoin

In July 2022, The Price of Bitcoin (BTC) Dropped Significantly, With Anverage Decline or about 20% per Day for Several Days. At its peak, Bitcoin was Trading at around $ 48,000, but by July 31st, it had declined to around $ 35,000.

One major contributor to this downturn was the order book imbalance in Ethereum (ETH). The price of ETH was heavy influenced by the supply and demand Dynamics on the Ethereum Network. On September 15th, 2022, A Large Withdrawal Event Occurred, Causing An Influx of ETH Into Exchanges and Leading to Significant Price Drops For The Asset.

TVL’s Impact on Market Volatility

Total Value Locked (TVL) Can Significantly Impact Market Volatility in Several Ways:

- Increased Price Sensitivity : When TVL is High, Markets Become More Sensitive to Changes in Supply and Demand Dynamics. This can lead to rapid price fluctuation as traders adjust their positions accordingly.

- Market Capitalization Amplification : A Large TVL on a particular asset can Amplify Market Capitalization Effects, Making Small Price Movements Feel Much More Significant than actual are.

- Order Book Distortion : Imbalances in the Order Book Can Distort Price Dynamics and Lead to Unexpected Price Movements.

Conclusion

The Complex InterPlay between Crypto Prices, TVL, and Order Books Makes for a Fascinating and Dynamic Market Environment. While a Healthy Order Book with Low TVL is Essential for Maintaining Stable Prices, An Imbalanced Order Book Or High TVL on a Private Asset Canet Cin Create Significant Price Volatility.

To Navigate Thesis Complexities, Investors Need to Stay Informed About Market Dynamics, Including Changes in TVL and Order Book Activity. By understanding how thesis Factors Influence Each Other, Traders and Investors Can Better Anticipate Potential Price Movements and Make More Informed Decisions.

References

- “The order book” by Cointelegraph

- “How Total Value Locked (TVL) Works” By CryptoSlate

3.

VN

VN