Understanding the action of pricing on the cryptocurrency market: an emphasis on algorand (algo)

The world of cryptocurrency has had a rapid growth and fluctuation in recent years. One of the key factors that determine this growth is the increasing demand for digital currencies, as several people are aware of their potential to provide a safe, decentralized way to store the value and to carry out transactions, without the need. of intermediaries such as banks.

However, navigation in the complex world of cryptocurrency can be intimidating, especially when it comes to understanding the action of prices. Here the technical analysis plays a crucial role in making informed investment decisions. In this article, we will focus on Algorand (ALGO), a decentralized public blockchain and a consensus algorithm that he has won traction on the cryptocurrency market.

What is the action of prices?

The action of prices refers to the real movement of the prices of a digital asset over time. It is the final result of all transactions, purchase and sales, which take place on various exchanges, including scholarships, futures markets and cryptocurrency exchanges. To understand the action of prices, you must be able to identify the patterns, trends and other market indicators.

Algorand (Algo): a decentralized blockchain

Algorand is a decentralized public blockchain developed by R3, a Swiss software company. It was launched in 2017 as an alternative to traditional blockchain platforms such as Bitcoin and Ethereum. Algorand’s blockchain is designed to be more efficient, scalable and safe than his competitors.

The key features of Algorand

Some key features that differentiate algorand from other blockchains include:

* The consensus algorithm on Saturday : Instead of relying on complex consensus mechanisms, such as work proof (POW) or Saturday (POS), algorrand uses a simpler, more efficient algorithm From an energy point of view, called on Saturday.

* High-speed processing : Algorand’s blockchain is designed to process transactions at speed comparable to those of traditional financial systems.

* Scalability : The algorrand consensus algorithm allows the processing of faster and cheaper transactions than traditional blockchain.

Understanding the action of price prices on algorand

When analyzing the action of prices on Algorand, traders and investors can use various technical indicators to identify trends, patterns and other market signals. Here are some key points to consider:

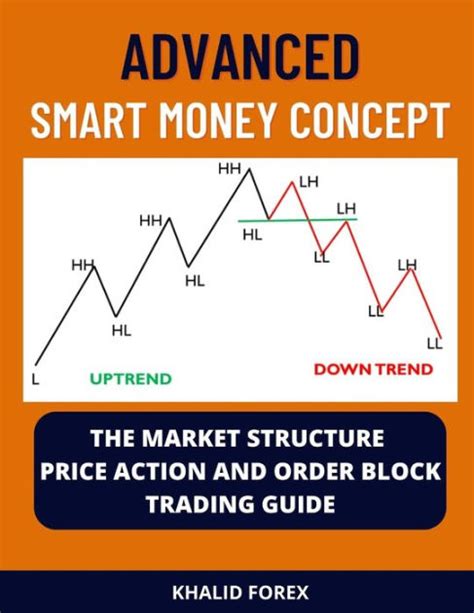

* Identification of trends : Traders can look for long -term trends of Algo price, such as an ascending or descending impulse.

* Support and resistance levels : Identify areas where prices tend to jump or stop, which can be useful for establishing trading strategies.

* Bullish and begging indicators : Looking for technical indicators, such as relative force index (RSI), Bollinger bands and moving media to evaluate the power of trend.

Indicators and diagrams

Some popular indicators used in the analysis of the action of price algorand includes:

* Mobile environments : Traders use different types of mobile environments (for example, simple motion (SMA) and exponential mobile media (EMA)) to identify trends and predict future price movements.

* Relative resistance index (RSI) : An impulse indicator that measures the extent of recent price changes to determine over -stated conditions or surveillance.

* Bollinger bands : A volatility indicator that plins a medium moving tape with standard deviations, providing a perspective on price movements.

Diagram patterns and trends

Traders can look for diagram patterns such as:

* triangles

: Bullish models that form when prices move in a consistent direction, while showing signs of strength.

* Waves : Cyclic models in which the price moves in a direction while withdrawing or diverging from it.

VN

VN